Flexible Global Carbon Pricing

The climate game is a multi-player prisoners’ dilemma. That makes cooperation unlikely without:

- Inducements to cooperate — carrots and sticks

- High benefits and low costs of cooperation

- Simple, low-conflict parameters to negotiate

- A widely held perception of fairness

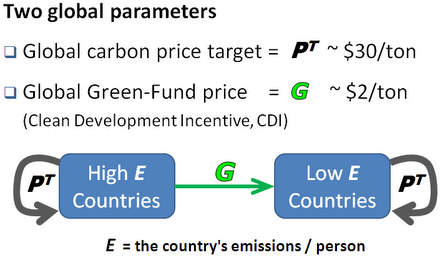

FGCP achieves these goals using a simple two-part design. Each part is controlled by a single global parameter determined by international negotiation, as illustrated below:

FGCP Summary

PT = Global Carbon Price Target G = Green Fund incentive rate Z = Global pricing incentive rate P = Global average carbon price Eg = Global emissions per-capita E = National emissions/capita R = National carbon emissions P = National carbon price, R/E The Carbon Pricing Incentive: A country’s target revenue/capita: Rule 1: R* = PT × EA country’s pricing incentive payment per capita Rule 2: paid = Z × (R – R*) Rule 3: Adjust Z so P hits PT The Clean Development Incentive: Rule 4: paid = G × ( Eg – E ) Rule 5: Reduce payment by P/PT |

Rule 1: A country’s target revenue = R* = PT× E, where E = total national carbon emission. It’s actual carbon revenue is R.

Carbon revenues can come from cap-and-trade, fossil-fuel taxes and feebates. As with caps, over- and under-achievement of the target price (or equivalently, target revenue) is inevitable, and as with caps, an over-achiever can sell carbon-revenue credits and an under-achiever must buy them. This works through a central market in which the effective price, Z, is adjusted annually.

Rule 2: A country is paid Z × ( R – R* ), where Z ~ 10%.

Note that if actual carbon revenue R < R*, then the country is paid a negative amount, or in other words must pay. The parameter Z is set automatically to control the global average price of carbon. Increasing Z rewards over-achievers more and charges under-achiever more, so raising Z encourages all countries to raise their carbon prices and collect more carbon revenue. The leads to

Rule 3: Adjust Z annually to make the global average carbon price, P, equal PT, the price target.

This completes the main carbon pricing mechanism, so we turn now to the Green Fund, which transfers funds from high-emission countries to low-emission countries according to Rule 4.

Rule 4: A country is paid G × ( Eg – E ), where E is the country’s and Eg is the world’s emissions per capita.

Rule 4 holds for high-emission countries and for low-emission countries that are collecting their target carbon revenues. But the Green Fund should be used to provide an incentive for low-emission countries to participate and comply with global carbon pricing, and this is accomplished with the Clean Development Incentive.

Rule 5: If a country’s carbon price, P, is less than PT, its Green-Fund payment is scaled back by: P / PT.

This completes the basic rules of Flexible Global Carbon Pricing.